Do You know?

Value Added Tax (VAT) is a tax applicable on sale of goods within State. VAT is a state level tax and is governed by different law for each state. For example, in the state of Delhi, any person with turnover exceeding Rs. 10,00,000 in Delhi is required to be registered under Delhi VAT and is liable to collect and pay VAT tax to the state Government. Further, any person purchasing or selling good from/to outside Delhi is also liable to be registered under DVAT in addition to registration under Central Sales Tax Act (CST).

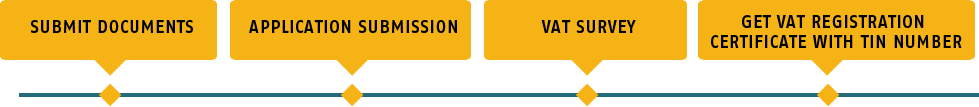

- Copy of important documents such as the address proof, ID proof of the proprietor/Partner/Director

- Four PP size photographs of the Proprietor/Partner/Director

- PAN No. of the Proprietor/Partner/Director

- Bank Account Details and Latest Bank Statement

- Copy of the rental agreement of the business place

- Details of business activities

- Partnership deed (in case of a partnership firm)

- Bank Guarantee or Surety from 2 existing VAT dealers

2015

All rights reserved. GPM & CO

2015

All rights reserved. GPM & CO